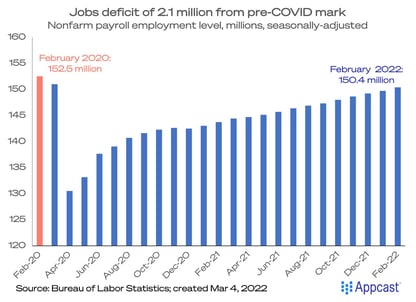

The U.S. labor market is humming along, and there is a rapid closing of the job deficit from COVID recession. During Q1 the recovery of the labor market accelerated, and all months added more net new jobs than expected. Encouragingly, participation in the labor force is rising in response to employer demand, though the numbers do not yet reflect economic uncertainty from global affairs and the latest domestic issues.

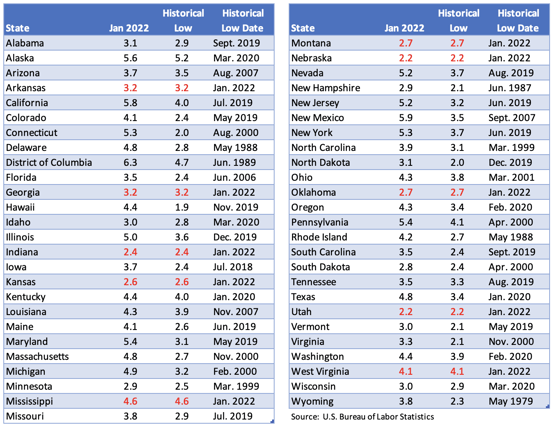

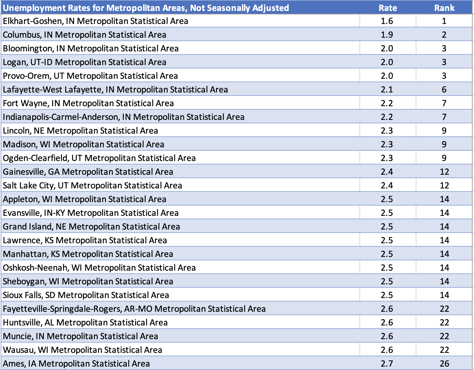

The share of the population with a job has continually increased throughout the first quarter of 2022, most noticeably for workers ages 25-54 years old, and this statistic is on track to hit its pre-pandemic levels in May. As a result, the unemployment rate continues to decline and has hit historic lows in 14 states. Those states are marked in red in the table shown, alongside all other states. The 25 metro areas with the lowest unemployment rates reflect that states in the Midwest like Indiana, Kansas, Nebraska, and Wisconsin have the tightest labor markets.

Low Labor Participation Rate

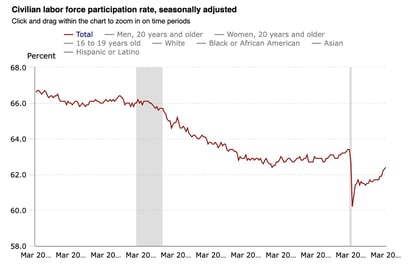

The challenge is still a lack of workers. Long before the pandemic, the percentage of Americans participating in the work force (those who had a job or were actively looking for one) had been declining, mainly due to the demographic of retiring Boomers. While the participation rate has bounced from its pandemic low, it has not yet reached pre-pandemic levels, which is still considerably lower than previous decades. You can visualize just how much labor market participation has fallen over the last two decades in the Civilian Labor Force Participation Rate graph here.

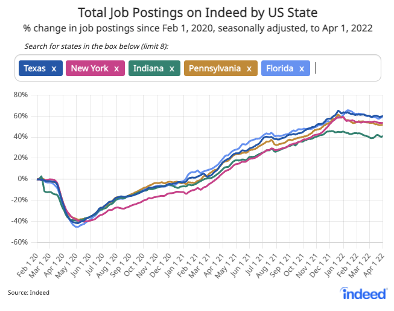

Combin ed with an incredibly high number of job postings that appear to be maintaining, employer competition for talent is fierce. The chart here provides an example from a variety of states of total job postings over time. Even with a plateau in job postings recently, the Bureau of Labor Statistics still reports well over 10 million job openings in the U.S.

ed with an incredibly high number of job postings that appear to be maintaining, employer competition for talent is fierce. The chart here provides an example from a variety of states of total job postings over time. Even with a plateau in job postings recently, the Bureau of Labor Statistics still reports well over 10 million job openings in the U.S.

What does this mean for businesses looking to hire?

While labor participation is improving, companies will still face a significant labor shortage overall for the indeterminate future. With record unemployment lows in many states, quality talent will continue to be a challenge to find. Wage rates have increased due to the competition for scarce workers, but while stable growth is considered to be a positive indicator for labor market recovery, continually increasing benchmarks for higher employer costs to acquire and retain talent are unsustainable as a strategy for talent acquisition.

Key Takeaways

- Finding quality talent is an always-evolving challenge with less people in the workforce across the board and higher competition for many jobs. Unemployment is at record lows in 14 states.

- Recruitment marketing costs continue to rise. Getting creative with your marketing solutions is essential.

- Talent acquisition takes an ever-increasing amount of HR professionals’ time, and dedicated resources and partners are paramount for success.

- Recovery across all COVID-affected industries (e.g., food service, retail, hospitality, etc.) is causing greater strain on employers seeking frontline employees across all industry sectors--healthcare, manufacturing, transportation and warehousing, and beyond.

If your talent acquisition function finds it difficult to meet business demands or you’re searching for alternative solutions, a partnership with Source2 could make sense for you. Connect with our executive team at solutions@source2.com for more information regarding our low-risk, short-term pilot programs and to discuss the specifics of your business situation.

Apr 11, 2022 5:46:06 PM